This week’s top stories

Zepto co-founders Aadit Palicha (left) and Kaivalya Vohra

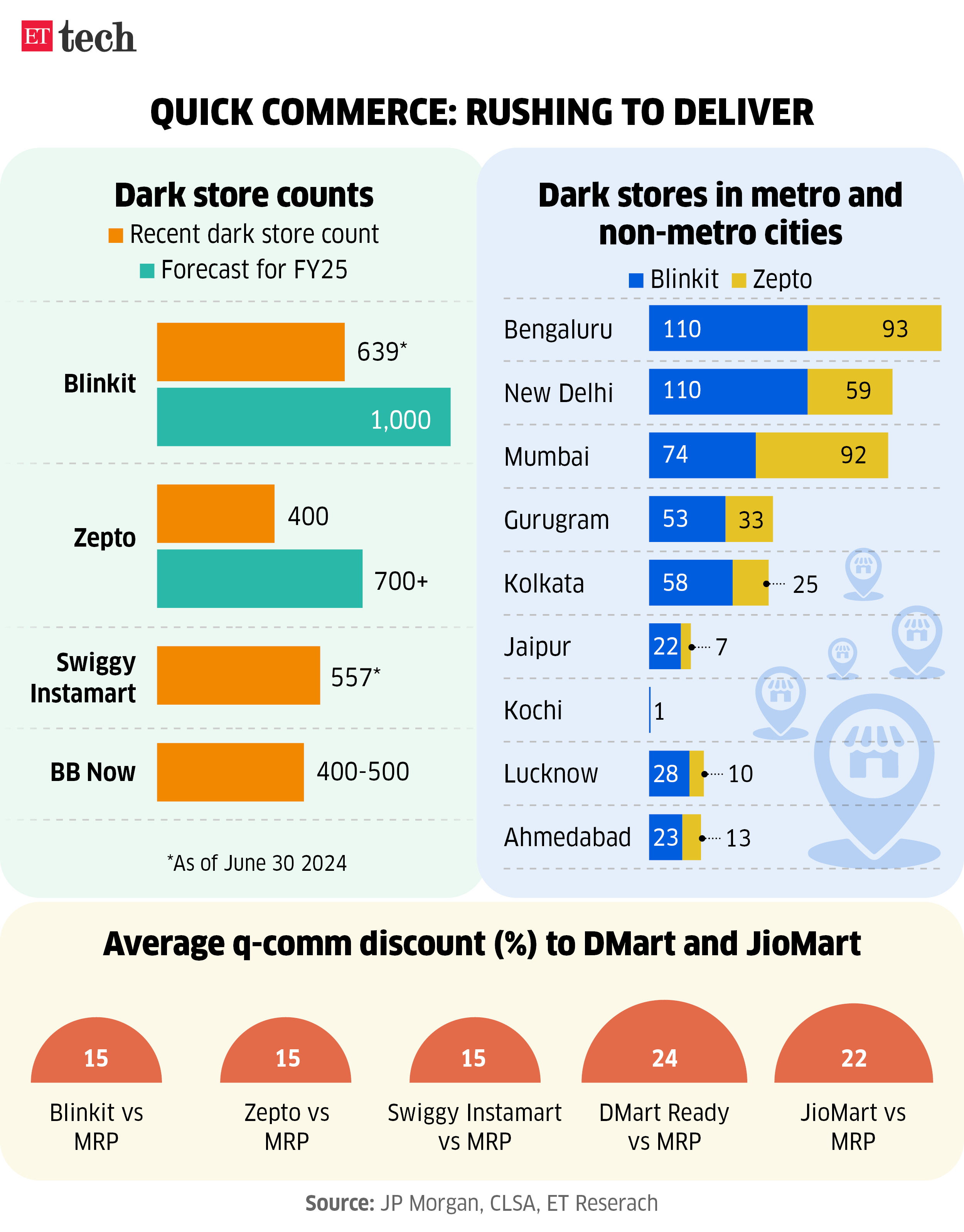

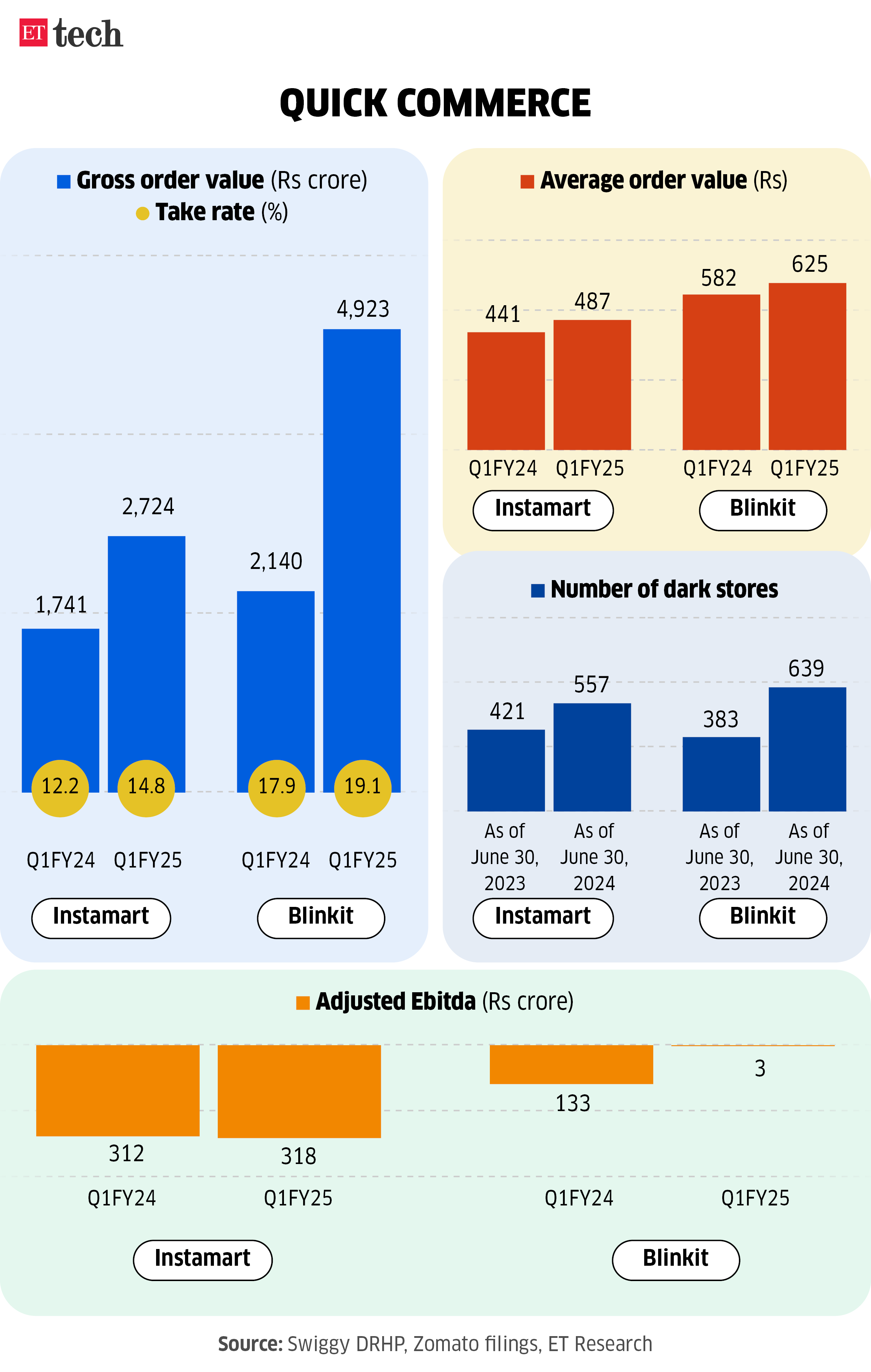

Tiger Global focuses on Zept stock amid rapid commercial rush: New York-based investment firm Tiger Global is conducting due diligence on quick commerce giant Zept’s dark store in Bengaluru, showing strong interest in the startup, which is currently valued at $5 billion. three people familiar with the matter said.

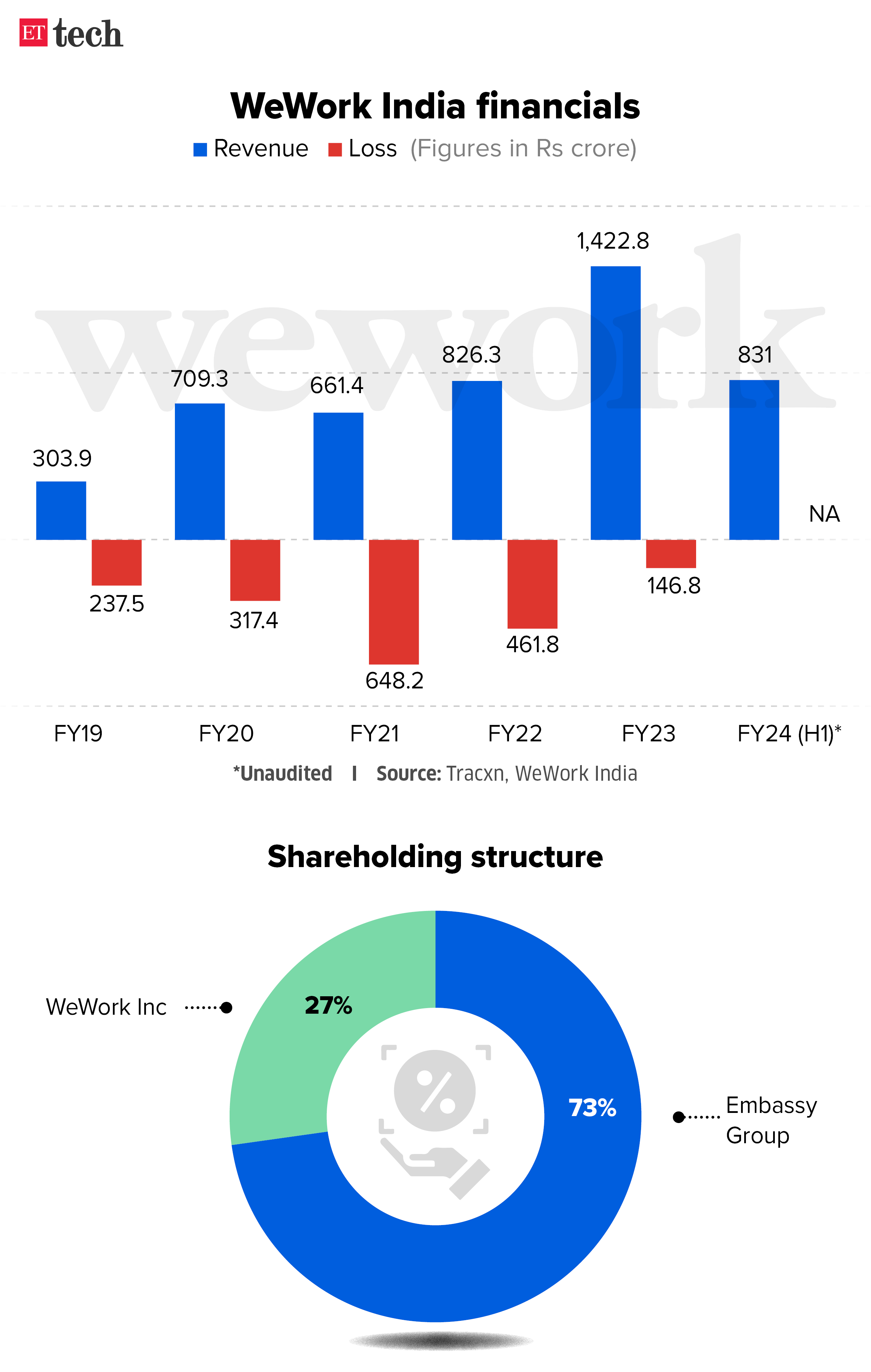

WeWork’s deal to exit India falls through amid a resurgence in its next sector. Plans for WeWork to sell its 27% stake in the Indian unit and exit the country have collapsed, three people familiar with the matter said. “Even after receiving regulatory nod from India’s antitrust agency, the deal was not completed due to valuation discrepancies,” one of the people said.

Lion’s share in Swiggy’s IPO will lead to an increase in the number of Instamart dark stores. The updated prospectus filed by Swiggy for its IPO on Thursday sheds light on the Bangalore-based company’s plans to continue investing heavily in quick-commerce industry Instamart. The bulk of the new capital proceeds from the IPO (Rs 982 crore) is expected to be used to expand Instamart’s dark store footprint.

Also read | Swiggy IPO: Prosus could fetch $500 million. Founder gets $36 million via secondary

Foxconn plans a $1 billion display assembly unit in Tamil Nadu. Foxconn is considering investing about $1 billion to set up a smartphone display module assembly unit in Tamil Nadu, according to people involved in the development.

Betting app Fiewin is targeted for ED. assets attached Including cryptocurrencies on Binance: In a major crackdown on illegal online applications related to Chinese nationals, the Enforcement Directorate (ED) has attached assets, including those stored in wallets of crypto giant Binance, sources told ET.

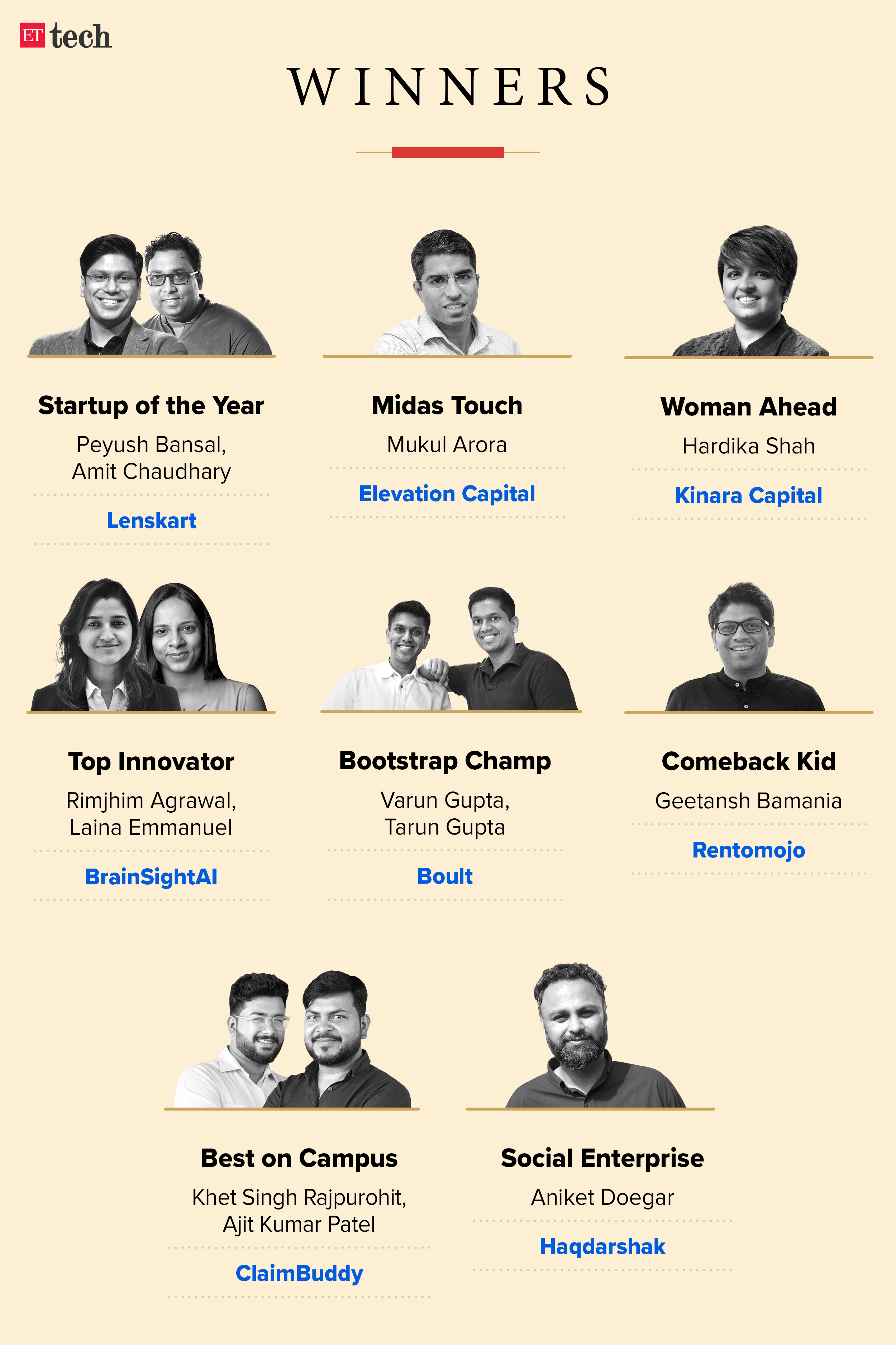

ET Startup Award 2024

ET Startup Awards @10: 10 years of startup success stories | As the Economic Times Startup Awards (ETSA) gears up to celebrate its 10th edition, we look at how it has recognized the best in entrepreneurship and chronicled the rise and fall of the industry over the past decade. Let’s look back.

ETSA’s journey has reflected the growth of India’s startup ecosystem over various cycles. This year’s elite jury consists of past ETSA winners such as Albinder Dhindsa of Blinkit, Ritesh Arora of BrowserStack, and Nikhil Kamith of Zerodha, highlighting how the winners have been aiming high over the years. did.

Fintech corner

Discount brokers are engaged in the margin funding business with an eye to revenue channels. Discount brokers are increasingly moving into margin financing to diversify their revenue channels as futures and options (F&O) trading, their core revenue source, comes under regulatory scrutiny. .

Banking tech companies benefit as fintech rewires business: As the financial services ecosystem grapples with a large-scale digitization drive, opportunities are opening up for startups like Zeta and M2P Fintech, which provide banking technology to banks and financial service providers.

Wealthtech sector leverages AI models to reinvent business | Rapid developments around large-scale language models (LLM) and artificial intelligence are seeing early adoption in India’s burgeoning wealthtech sector.

Decoding the roller coaster ride of PB fintech stocks | The wild swings in PB Fintech’s stock price came after investors were spooked by news reports that the insurance and credit market operator was considering entering the highly competitive healthcare business with its own hospital chain. Ta.

Zerodha posted a profit of Rs 4,700 crore in FY24. New F&O rules expected to reduce revenue by 30-50%: Nithin Kamith | Kamath said in a blog post that Sebi’s regulatory changes will have an adverse impact on the company’s revenue. Sebi’s ‘True to label’ circular will reduce revenue by 10% and new rules on index derivatives will reduce the company’s revenue by 30% to 50%.

IT updates

IT companies score strong deals in second quarter after long stagnation | India’s IT giants have signed more contracts this quarter than in the previous quarter, indicating demand momentum is on track to recover after a deep slump, and the US Federal Reserve ) interest rate cuts are expected to result in more strong contract acquisitions.

IT recruitment is showing signs of resurgence with H2 demand increasing by 10-12%. Employment in India’s information technology (IT) sector has started recovering from the first half of the current fiscal year after a weak fiscal year 2024, with year-on-year (YoY) growth expected to accelerate over the next six months.

As India embraces Industry 4.0, local manufacturing, there is a surge in recruitment for operational technology roles. With India’s increasing focus on Industry 4.0 and local manufacturing, sectors such as manufacturing, energy, and infrastructure are seeing an increased role for operational technology.

#weeks #top #startup #technology #articles